Book to Bill Ratio – Last 36 months with trend line

Authorised Distributors Forecast Low Single Digit Growth in 2026

At the end of each year the Electronic Components Supply Network (ecsn) canvases its manufacturer authorised distributor (afdec) and electronic components manufacturing member companies for their opinion on how their businesses, and the electronic components supply industry in general, will fare in the coming year. The association’s statisticians and analysts use the data collected to compile the annual ecsn UK & Ireland Electronic Components Market Forecast. Released on 27th November 2025, the latest Forecast does encompass the entire year but current market conditions and geopolitical turbulence have again made forecasting twelve months ahead somewhat uncertain.

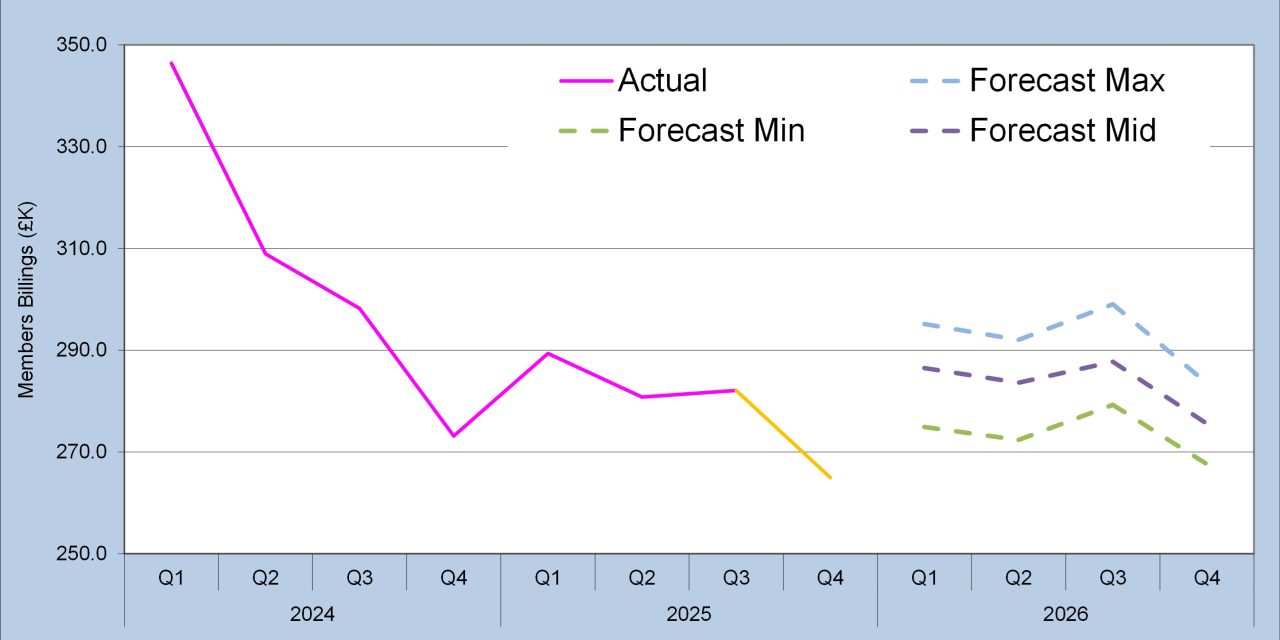

“The ‘Billings’ (sales revenue) decline in the UK and Ireland electronic components markets throughout 2025 and exceeded the lower end of the predictions ecsn members made in the Forecast we released at the end of last year,” said the association’s chairman Adam Fletcher. “We predicted single digit ‘Billings’ (sales revenue) growth in the range (4.9%)-to-2% compared to 2024. Audited figures are not yet available, but all the indications are that the 2025 outcome will be a decline of (9%) due to continuing weak demand for components exacerbated by the ongoing industry-wide inventory overhang”.

Fletcher primarily attributes the lack of demand to the stall in global GDP triggered by US Trade Tariffs, but also cites other factors including the ongoing geopolitical tensions resulting from Russia’s invasion of Ukraine, conflicts in the Middle East and the escalating trade war between the US and China: “Industry demand for electronic components has slowed in the UK with excess customer inventory taking longer to be consumed than in a normal market”, Fletcher said. “ecsn members report that customers are progressively ‘consuming’ their in-house inventory and as a result are making more short-term purchases, but in the light of diminishing levels of international trade their overall confidence is still weak, and their customer forward order books remain opaque.”

ecsn’s UK & Ireland Electronic Components Market Forecast 2026

The Forecast released by ecsn’s Leadership Group and presented by the association’s market analyst, Aubrey Dunford, predicts that the UK & Ireland electronic components market will continue to decline in the first half of 2026 and that sales revenues (Billings) will shrink between (4%)-to-3% compared to last year and show a mid-point result of around (0%). In the second half of the year the association predicts that ‘Billings’ will recover modestly in the range 1%-to-6% to give an outcome for the full year in the range (2.1%)-to-4.7% compared to 2025 but will show only 1.4% growth at the mid-point. Dunford however still sees many reasons to be optimistic about the industry prospects for 2026 as innovation creates new market opportunities. “Underlying demand for electronics in virtually every area of modern life is showing no signs of slowing down, which is why ecsn is forecasting a return to growth in 2026. Sadly, we now believe that we’ll have to wait until the second half of the year before the upswing begins, although the actual timing and scale of that growth remains difficult to determine.”

Market overview

In the UK, and indeed in most of Europe the market for electronic components is primarily driven by the Automotive, Industrial and Medical-equipment sectors. For obvious reasons the Military and Aerospace sectors remain very strong but represent only a small (but important) proportion of the total market and today OEM and CEM manufacturing in the sector is fully utilised and requires investment in additional capacity. The below-expected take up of electric vehicles (EV) has negatively impacted the Automotive sector but sales will improve, especially if direct consumer subsidies increase and Asian manufacturers boost their investment in manufacturing capacity via inward investment in the UK and Europe. The roll-out of 5G and particularly the ‘back-hauling’ infrastructure continues to enable more IOT applications, while the deployment of Artificial Intelligence (AI) in datacentres is certain to continue along its exponential growth curve. Real-world applications of AI in mainstream computing, consumer, mobile handsets and in industrial & medical equipment is probably two to five years away from making any major revenue impact in the UK / Ireland market

In the Forecast for 2025 delivered at the end of 2024 ecsn members concluded that the UK market for electronic components was difficult to predict because the entire supply network had become overstocked, masking the real underlying demand: “We were right when we said that the market was difficult to judge but we were completely wrong in predicting the demand for electronic components in 2024 and in 2025”, admitted Aubrey Dunford: “At that time the US’s policy on the imposition of Trade Tariffs was an “unknown, unknown” but the ‘across-the-board’ Tariffs it imposed this year have hugely disrupted global supply networks, suppressed global demand and create artificial stop / go demand cycles around the arbitrary and changeable implementation dates and the ‘concessions’ granted by the President”, Dunford said. “The impact of the US’s actions has suppressed global economic growth and as a result extended the ‘post-Covid’ customer inventory overhang of electronic components much longer than ecsn member companies expected. However, the global customer inventory overhang is being quickly ‘consumed’ and should return to normal levels in 1H’26”.

ecsn chairman Adam Fletcher observed that despite a widespread confidence throughout the global semiconductor industry, in reality growth in the semiconductor market is currently being driven solely by demand for the specialised memory products that leading-edge Graphic Processing Units (GPUs) need to operate the Large Language Models (LLMs) behind the latest Artificial Intelligence (AI) applications: “Other sectors of the semiconductor market have not seen the same upturn and many manufacturers are still holding elevated inventory levels, particularly of microcontrollers, standard logic and analogue devices”’, Fletcher said. “It is likely that 2025 will close out showing that the UK electronic components Distributor Total Available Market (DTAM) will have declined by nearly (9%), a significantly lower result than our members had expected, but the passive and electro-mechanical sectors (including interconnect) have managed to get their inventory back into balance and are currently at the vanguard of the trend towards growth”.

In a normal ‘reasonable’ growth market most geographic regions including Asia and the US would see the Book-to-Bill ratio hover around 1.05:1 but in Europe and Japan the B2B remained stubbornly below unity in 1H’25, before picking up significantly in Q3’25: Fletcher is concerned that UK customers are now in danger of falling behind the general curve by failing to add reasonable forward order cover with their suppliers: “These organisations could find themselves at the back of the queue when the market improves and they need materials”, Fletcher said. “Given that the average lead-time across all electronic components is currently sixteen weeks and looks likely to extend further as we move into 2026, I strongly encourage Procurement Professionals to review their forward order cover (backlog) on their suppliers and act accordingly”.

Up and to the right

Despite ecsn forecasting essentially “flat” growth in 2026, Dunford and Fletcher are confident that the mid- and long-term trajectory for UK/Ireland and global electronic components markets continues to be ‘up and to the right’ and see a return to stronger underlying growth in 2H 2026, but recognise that many geopolitical and economic uncertainties still threaten to destabilise the supply and demand balances in the market: “I encourage all organisations to play their part in our industry’s continuing success by participating and contributing to the collaboration process that continues to gain traction up and down the supply network”, Fletcher concluded. “Increased industry collaboration in 2026 and beyond will add very little to an organisation’s costs but could boost its competitive advantage to benefit them, their supply partners and the UK / Ireland economy”.

For more news please visit: News – CIE